Oh everyday, it's getting closer

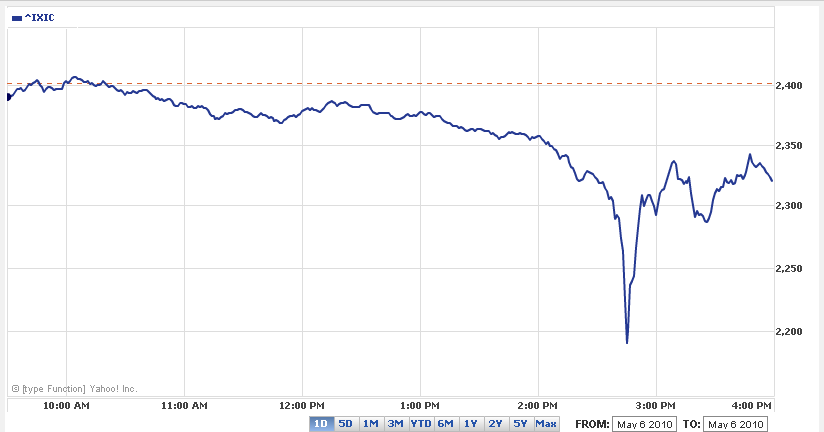

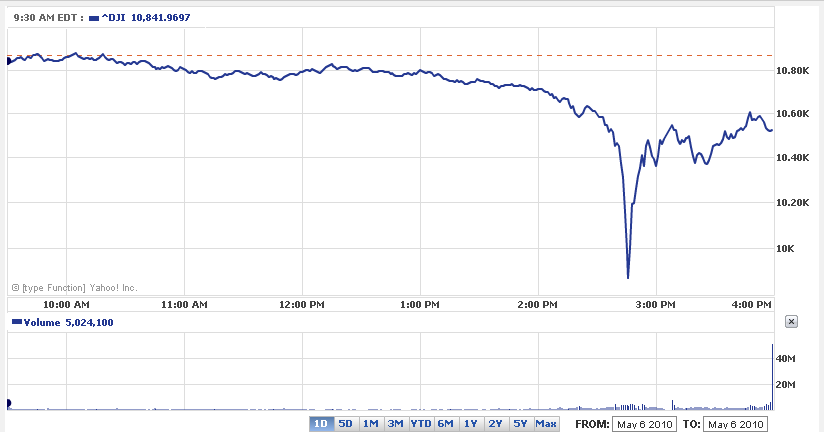

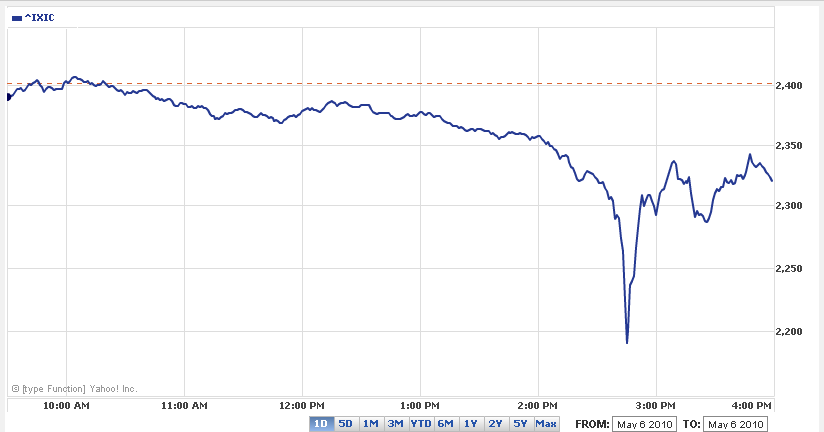

Going faster than a roller coaster...(click the images to see in the original size)

A friend passed along some comments he saw on Slashdot:

"Frankly, I was more comfortable with the concept that the DOW could drop 1000 points in one afternoon due to some obscure overseas debt concerns than I am the idea that the DOW can drop 1000 points in one afternoon because of a fucking typo. I realize that markets and the economy in general are collective illusions to begin with and all that, but do we really need to be reminded quite so forcefully? Might be time to invest my money in something a little more solid, like canned food and ammunition."

"You might be happier with a Whisky and Prostitutes ETF. Consult your broker today."

"It wasn't a typo, it was Bernie Sanders speaking for an hour on the Senate floor today, pushing for a bill to audit the Fed. Everyone who is anyone knows what we will find if we audit the Fed, and it isn't good. Not just for us, but for the world. Which is why Obama threatened to veto this bill, citing national security. The dollar is the world's reserve currency. If all the plebeians of the world found out how utterly worthless our currency is, we would suffer a crash that would make the last one look like a cake-walk. As for Greece, though, that crisis is actually pushing investors back to America."

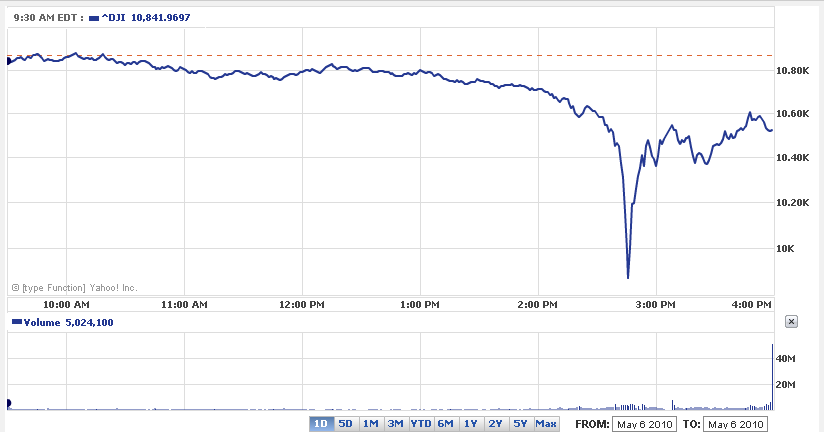

It was an interesting afternoon, to say the least. Around a quarter to 5, I checked Yahoo Finance and saw the early reports of a trader making a typo, entering "billion" instead of "million." I don't believe that for a second, because such quantities would be entered as Arabic numerals, not written out.

Then there's the problem of share float. Most stocks don't have billions of shares outstanding. P&G does have about 2.9 billion, but then what happens when orders are actually placed? No single entity would have the billions of shares to sell, and moreover, traders looking to buy would see the number and think, "Uh, something's gotta be wrong there."

Even if a single trade did do all this, the markets would have snapped back much faster. If someone's selling something at a huge discount, then buyers will think "Great!" and start snapping it up. Once the supply is gone, the market price will return to normal. Think of strawberries at a grocery store that are mistakenly priced at 10 cents a pound. Once the error is corrected, whether with that supply or a new supply, the price will snap back.

P&G seems to be the current scapegoat, but that raises a couple of questions. So here's another question. P&G is a component of the DJIA, but even if it were completely wiped out, there are 29 other components. One component could plunge to zero, and the others could be down, say, 5%, yet the DJIA would still be 91.8% of its previous value.

The S&P 500 and NASDAQ had similar drops -- but PG is only 1/500th of the S&P 500, and it isn't part of the NASDAQ 100.

But never mind PG. What happened to ACN?

I can't help but feel something sinister happened today, and not in liberals' anti-capitalist way of blaming evil banks and uncontrollable computer algorithms. Whatever happens, look for Obama and his cronies to take advantage of the situation.

"You never want a serious crisis to go to waste. What I mean by that is an opportunity to do things that you think you could not do before."Update:

NASDAQ is cancelling trades from 2:40 to 2:50 on a great many stocks, including ACN. The criterium is if "the quote deviated more than 60 percent away from the consolidated last print in that security at about 2:40 p.m."